Exness Copy Trade stands as a pioneering feature in the world of online trading, offering a dynamic platform for both novices and seasoned traders. This innovative approach allows individuals to copy the trades of experienced investors, thereby demystifying the complex world of trading. Exness, known for its robust trading solutions, introduces Copy Trade Exness, a tool that transforms how individuals interact with the financial markets. This system not only simplifies trading for beginners but also opens new avenues for skilled traders to expand their influence and potentially earn more by sharing their strategies. With Exness Social Trading, the power of professional trading strategies becomes accessible to everyone, marking a significant leap in online trading possibilities.

- Benefits of Exness Copy Trade

- For Beginner Traders

- For Experienced Traders

- How to Get Started with Exness Copy Trade

- Account Registration

- Selecting a Trader to Copy

- Key Features of Exness Copy Trade

- Risk Management Tools

- Variety of Tradable Assets

- Strategies for Successful Copy Trading

- Diversification

- Setting Limits and Goals

- Understanding the Risks

- Market Volatility

- Reliance on Other Traders’ Expertise

- Legal and Regulatory Aspects of Exness Copy Trade

- Compliance with Regulations

- Security Measures

- Tips for New Users

- Starting Small

- Continuous Learning

- Conclusion

Benefits of Exness Copy Trade

The benefits of Exness Social Trading are numerous and impactful for traders of all skill levels. Beginners gain a unique opportunity to learn directly from experienced traders, effectively shortening their learning curve. By copying the strategies of seasoned investors, newcomers can avoid common pitfalls and gain insights into effective trading techniques. For the experienced traders, Exness Copy Trade offers a platform to amplify their strategies and earn additional income from their followers. This feature also enhances the trading community by fostering a learning environment where knowledge and strategies are shared. Moreover, the diversity of tradable assets and risk management tools available on Exness makes it a versatile choice, catering to the varied needs and preferences of traders worldwide.

For Beginner Traders

For beginner traders, Exness Copy Trade serves as an invaluable tool for entering the world of trading. It allows them to actively engage in the market while learning from the expertise of seasoned traders. This hands-on experience accelerates their learning process, enabling them to understand market dynamics and strategies more effectively. Beginners can also tailor their risk exposure by choosing traders whose risk levels and trading styles match their own preferences. This approach significantly reduces the initial barriers and uncertainties often faced by new traders, providing a more confident and informed start in their trading journey.

For Experienced Traders

Experienced traders find in Exness Social Trading a unique opportunity to broaden their impact and earn additional income. By sharing their trading strategies, they not only help beginners but also gain recognition and a follower base within the trading community. This platform allows them to monetize their expertise, as followers’ trades provide them with a potential source of passive income. Furthermore, experienced traders can leverage this feature to test new strategies in a diverse market environment, refining their skills and expanding their trading portfolio. The collaborative nature of Exness Copy Trade thus serves as a valuable tool for personal growth and community engagement for these seasoned investors.

How to Get Started with Exness Copy Trade

Getting started with Exness Copy Trade is a straightforward process, designed to quickly integrate traders into the world of copy trading. First, you need to register an account with Exness, ensuring you have completed all necessary verification steps for a secure and compliant trading experience. Once your account is set up, you can explore the list of available traders to copy.

This crucial step involves assessing their trading styles, risk levels, and historical performance to find a match that aligns with your trading goals and risk tolerance. After selecting a trader, you can allocate a portion of your funds to start copying their trades. Exness provides tools and features to monitor and manage your copy trading activities, allowing you to adjust your strategy as needed. This process not only introduces you to the trading world but also provides a platform for continuous learning and adaptation in your trading journey.

Account Registration

Registering an account with Exness for using the Copy Trade feature is a streamlined process:

- Visit the Exness Website. Start by navigating to the Exness official website.

- Sign Up for an Account. Locate the registration or sign-up section and fill in your personal details such as name, email address, and phone number.

- Set Your Login Credentials. Create a username and a strong password for your account. This step is crucial for ensuring the security of your account.

- Verify Your Email and Phone Number. You will receive a verification link in your email and a code on your phone. Complete this step to confirm the authenticity of your contact information.

- Provide Necessary Documentation. For identity verification, upload the required documents, typically including government-issued ID and proof of residence. This is an important step for regulatory compliance.

- Choose Your Account Type. Exness offers different types of accounts to cater to various trading needs. Select the one that best suits your trading style and experience level.

- Fund Your Account. After your account is verified, deposit funds to start trading. This also enables you to start using the Copy Trade feature.

Relevant Article: Exness Sign Up

Remember, it’s important to familiarize yourself with the terms and conditions of Exness, and ensure you understand the risks involved in trading before you begin.

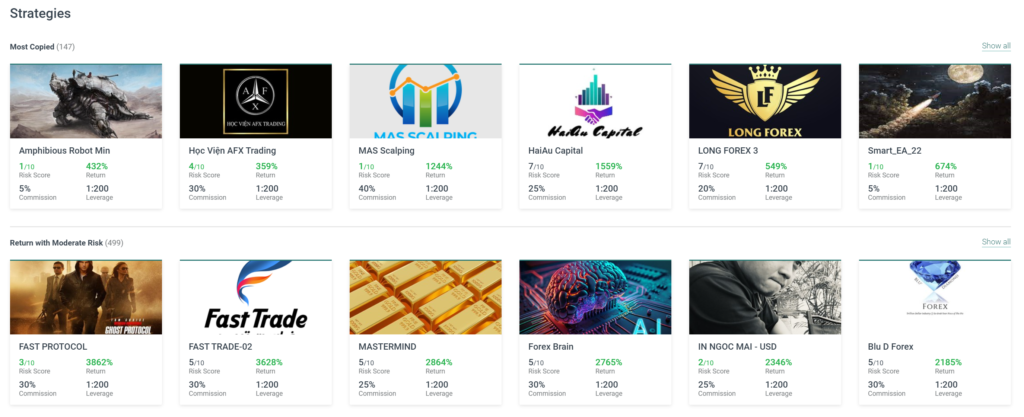

Selecting a Trader to Copy

Selecting a trader to copy on Exness Social Trading involves a careful and strategic approach. First, assess your own trading goals and risk tolerance. This self-assessment guides you in choosing a trader whose style aligns with your objectives. Next, review the performance history of potential traders. Look for consistent profitability and a trading history that demonstrates resilience through various market conditions. It’s also important to consider the risk level of each trader. Choose someone whose risk approach matches your comfort level.

Diversifying your choice of traders can also be beneficial, as it spreads risk and exposure across different trading strategies and markets. Engage in the community forums or read reviews to get insights into the traders’ reputations and reliability. Lastly, start with a smaller investment when you begin to copy a trader. This allows you to test the waters before committing more significant funds. By following these steps, you can make an informed decision in selecting a trader that best suits your trading aspirations on Exness.

Key Features of Exness Copy Trade

Exness Copy Trade offers several key features that make it a standout choice for traders. One of the most notable is its user-friendly interface, which simplifies the process of copying trades and managing investments. The platform also provides a diverse range of tradable assets, including forex, commodities, and indices, allowing traders to diversify their portfolios easily. Risk management tools are another crucial feature, enabling users to set stop-loss and take-profit limits to protect their investments. The real-time copying mechanism ensures that your trades mirror the copied trader’s actions almost instantaneously, maintaining the relevance and timeliness of your trading strategy.

Additionally, Exness offers detailed analytics and reporting tools, giving traders insights into their copied trades’ performance and helping them make more informed decisions. Flexibility in choosing and changing copied traders allows users to adapt their strategies as their needs and market conditions evolve. These features collectively make Exness Copy Trade a robust and adaptable platform for both new and experienced traders.

Risk Management Tools

Exness Social Trading provides a suite of risk management tools to help traders effectively manage and mitigate risks:

- Stop-Loss Orders. Set a specific price at which your trade will automatically close to limit potential losses.

- Take-Profit Orders. Specify a price level to automatically close a profitable trade, securing your gains.

- Risk Limit Settings. Adjust the maximum amount of capital at risk for each copied trade, ensuring you only risk what you’re comfortable with.

- Balance Protection. This feature safeguards your account from going into a negative balance during volatile market conditions.

- Customizable Leverage. Choose your leverage ratio to control the risk and return level of your trades.

- Real-Time Alerts. Receive notifications on market movements and changes in the copied trader’s strategy, enabling quick response to risks.

- Performance Analytics. Access detailed analytics of your trades to assess risk exposure and adjust strategies accordingly.

These tools are crucial for maintaining control over your trading activities and protecting your investments in the dynamic trading environment of Exness Copy Trade.

Variety of Tradable Assets

Exness Copy Trade offers traders a wide variety of tradable assets, enhancing the flexibility and scope of their investment strategies:

- Forex Pairs. A vast selection of major, minor, and exotic currency pairs, catering to forex traders of all experience levels.

- Cryptocurrencies. Trade popular cryptocurrencies, staying ahead in the fast-growing digital currency market.

- Commodities. Includes precious metals like gold and silver, and energy commodities such as oil and natural gas.

- Indices. Access to global stock indices, allowing traders to diversify into broader market trends.

- Stocks. Opportunity to trade shares of leading companies from various sectors and countries.

- ETFs. Exchange-Traded Funds available for those who prefer diversified investment in baskets of assets.

This array of assets offers traders the opportunity to diversify their portfolios, explore different markets, and develop a trading strategy that aligns with their financial goals and risk tolerance.

Strategies for Successful Copy Trading

Adopting effective strategies is crucial for successful copy trading on Exness Social Trading. Here are key strategies to consider:

- Choose the Right Traders to Copy. Select traders whose strategies align with your risk tolerance and investment goals. Evaluate their track record, trading style, and performance consistency.

- Diversify Your Portfolio. Don’t rely on a single trader. Spread your investment across multiple traders to mitigate risk and capitalize on different market opportunities.

- Understand the Markets. While copy trading can be more passive, having a basic understanding of the markets and assets you’re investing in is beneficial.

- Set Clear Financial Goals. Define what you want to achieve with copy trading, whether it’s learning, earning, or both. This helps in selecting the right traders and adjusting strategies.

- Monitor Your Investments Regularly. Stay informed about your copy trades and the overall market conditions. This enables you to make timely adjustments if needed.

- Use Risk Management Tools. Leverage Exness’s risk management features like stop-loss orders to protect your capital.

- Start Small and Scale Up Gradually. Begin with a smaller investment to test the waters. As you gain more confidence and understanding, you can gradually increase your investment.

By following these strategies, you can optimize your copy trading experience, balancing the potential for profit with the management of risk.

Diversification

Diversification is a fundamental strategy in trading and investing, and it plays a crucial role in the context of Exness Copy Trade:

- Spread Risk Across Different Traders. Instead of copying a single trader, diversify by choosing several traders with varying strategies and specialties. This reduces dependency on any one trader’s performance.

- Explore Various Asset Classes. Utilize the diverse range of assets available on Exness, including forex, stocks, commodities, and cryptocurrencies, to spread your investment across different markets.

- Balance Risk and Reward. Mix traders with different risk profiles – some might be aggressive, while others are more conservative. This balance can help stabilize your portfolio’s performance.

- Geographical Diversification. Consider traders who specialize in different geographic markets to capitalize on various economic conditions and trends.

- Adapt to Market Changes. Diversification is not a set-and-forget strategy. Regularly review and adjust your choices based on market conditions and your investment goals.

- Limit Overexposure. Avoid concentrating too much capital on similar trading strategies or asset types, which can lead to increased risk.

By diversifying your copy trading activities, you reduce the impact of any single trader’s performance on your overall portfolio, leading to potentially more consistent and stable returns.

Setting Limits and Goals

Setting limits and goals is a vital aspect of a successful trading strategy, especially in Exness Social Trading:

- Define Investment Goals. Clearly outline what you aim to achieve with your investments, whether it’s long-term growth, income, or learning.

- Establish Risk Tolerance. Determine how much risk you are willing to take. This will guide your decisions on which traders to copy and how much to invest.

- Set Financial Limits. Decide the total amount of capital you are willing to allocate to copy trading. This helps in avoiding overexposure to the market.

- Use Stop-Loss Orders. Implement stop-loss orders to automatically close trades at a certain loss level, protecting your capital from significant downturns.

- Take-Profit Settings. Similarly, set take-profit levels to secure gains when your investments reach a certain profit margin.

- Regularly Review and Adjust. Periodically assess your investment performance and adjust your strategies, limits, and goals as needed.

- Balance Between Aggressive and Conservative Strategies. If your goal is growth, you might lean towards more aggressive strategies, but always balance them with conservative approaches to mitigate risk.

By setting clear limits and goals, you maintain control over your copy trading activities, ensuring they align with your overall financial strategy and risk appetite.

Understanding the Risks

Understanding the risks is essential when engaging in Exness Copy Trade. Firstly, market volatility is a significant factor. Prices of assets can fluctuate rapidly, affecting the value of your trades. Secondly, the success of your investments hinges largely on the decisions of the traders you copy. While they might be experienced, their strategies are not infallible and can lead to losses. Thirdly, there’s the risk of over-reliance on copy trading as a strategy. Diversifying your investment approach is crucial to mitigate this risk.

Additionally, technological risks, such as system failures or connectivity issues, can impact trade execution. It’s also important to consider the potential for changes in trading regulations, which can affect market conditions. Lastly, there’s the personal risk of not setting appropriate limits or not fully understanding the copied strategies. Being aware of these risks and managing them proactively is key to a successful copy trading experience with Exness.

Market Volatility

Market volatility is a crucial aspect to consider in Exness Social Trading and trading in general:

- Fluctuating Prices. Market prices can change rapidly and unpredictably, affecting the value of trades, especially in short-term investments.

- Impact on Trading Decisions. High volatility can lead to quick and significant changes in profit and loss, requiring swift decision-making.

- Risk and Reward. While volatility can present opportunities for high returns, it also increases the risk of losses.

- Importance of Diversification. Diversifying your trades across different assets and traders can help mitigate the risks associated with market volatility.

- Use of Stop-Loss Orders. Implementing stop-loss orders can protect your investments from large market swings.

- Staying Informed. Keeping up-to-date with market news and trends is vital in understanding and navigating through volatile periods.

- Long-Term Perspective. Adopting a long-term investment strategy can help offset the effects of short-term market fluctuations.

Understanding and managing market volatility is essential for traders using Exness Copy Trade to make informed decisions and protect their investments.

Reliance on Other Traders’ Expertise

- Expertise as an Asset. Copying trades from experienced traders leverages their knowledge and experience, which can be especially beneficial for beginners.

- Risk of Dependence. While beneficial, over-reliance on others can be risky. It’s important to remember that even expert traders can make mistakes or face losses.

- Diversification is Key. To mitigate the risks of reliance, diversify the traders you copy. This spreads the risk across different trading styles and strategies.

- Due Diligence. Conduct thorough research on the traders you choose to copy, looking at their track record, trading style, and risk management strategies.

- Balancing Autonomy and Copying. While copying trades, it’s also beneficial to develop your own trading skills and knowledge, gradually reducing dependence on others.

- Adaptability. Be prepared to adjust your copy trading choices as market conditions change or as you gain more insight into trading.

- Continuous Monitoring. Regularly monitor the performance of the traders you are copying to ensure their strategies still align with your investment goals.

Reliance on other traders’ expertise in Exness Copy Trade is a double-edged sword that requires careful consideration and ongoing management to maximize benefits and minimize risks.

Legal and Regulatory Aspects of Exness Copy Trade

The legal and regulatory aspects of Exness Copy Trade are crucial for ensuring a secure and compliant trading environment:

- Regulatory Compliance. Exness adheres to international financial regulations, providing a legal framework that governs its operations and ensures trader protection.

- Licensing and Registration. Exness holds necessary licenses from various financial regulatory authorities, affirming its legitimacy and adherence to financial standards.

- Data Protection. The platform is committed to safeguarding user data, adhering to strict data protection laws and employing advanced security measures.

- Transparency. Exness maintains a high level of transparency in its operations, including clear disclosure of terms, fees, and risks associated with copy trading.

- Anti-Money Laundering (AML) Policies. The platform implements robust AML procedures to prevent financial crimes, including thorough identity verification processes.

- Trade Execution and Fairness. Exness ensures fair and timely execution of trades, adhering to best practices to avoid conflicts of interest and provide equal opportunities for all traders.

- Client Funds Protection. The platform employs measures to protect client funds, including segregating client funds from the company’s operating funds.

Understanding these legal and regulatory aspects gives traders confidence in the integrity and reliability of Exness Copy Trade, ensuring a safe trading environment.

Compliance with Regulations

Exness Social Trading strictly complies with international financial regulations, ensuring a secure and legitimate trading environment. The platform adheres to the rules set by various financial regulatory authorities, confirming its commitment to legal and ethical trading practices. This compliance involves rigorous processes for identity verification, aligning with anti-money laundering (AML) and know-your-customer (KYC) norms. Exness takes proactive steps to update its policies and procedures in response to new regulatory requirements, reflecting its dedication to maintaining high standards of financial integrity. Such steadfast adherence to regulations not only protects the interests of traders but also reinforces the platform’s reputation as a trustworthy and reliable trading service provider.

Security Measures

Exness Copy Trade implements robust security measures to ensure the safety and integrity of its trading platform:

- Data Encryption. Uses advanced encryption technology to protect user data and financial transactions from unauthorized access.

- Two-Factor Authentication (2FA). Offers an additional layer of security for account access, requiring a second form of verification beyond just the password.

- Regular Security Audits. Conducts frequent audits to identify and address potential security vulnerabilities, keeping the platform safe and secure.

- Secure Payment Processing. Implements stringent security protocols for payment processing to prevent fraud and ensure the safety of financial transactions.

- User Privacy Protection. Adheres to strict privacy policies, ensuring that user information is confidential and not misused.

- Real-Time Monitoring. Employs real-time monitoring systems to detect and respond to any unusual or suspicious activity quickly.

- Continuous Updates. Regularly updates its security systems and protocols to stay ahead of evolving cyber threats.

These security measures play a critical role in safeguarding traders’ funds and personal information, making Exness Copy Trade a secure choice for online trading.

Tips for New Users

For new users starting with Exness Copy Trade, these tips can help navigate the platform effectively:

- Start Small. Begin with a modest investment to understand the platform’s dynamics without risking significant capital.

- Educate Yourself. Take time to learn about trading basics, copy trading mechanics, and market analysis to make informed decisions.

- Choose Traders Wisely. Research and select traders to copy based on their trading history, style, and performance, ensuring they align with your goals.

- Use Demo Accounts. Utilize demo accounts to practice and get a feel for the platform without financial risk.

- Implement Risk Management. Apply risk management tools like stop-loss orders and diversify your copy trading choices to mitigate potential losses.

- Stay Informed. Keep up with financial news and market trends as they can significantly impact your trading decisions.

- Regularly Review and Adjust. Monitor your investments regularly and be ready to adjust your strategies as you gain more experience and as market conditions change.

- Engage with the Community. Participate in forums and discussions to gain insights and tips from more experienced traders.

Relevant Article: Exness Login

By following these tips, new users can enhance their trading experience on Exness Copy Trade, balancing the potential for growth with prudent risk management.

Starting Small

Starting small is a wise strategy for new traders on Exness Social Trading. It allows you to familiarize yourself with the platform’s features and the dynamics of copy trading without significant financial exposure. Begin with a modest amount of capital that you’re comfortable potentially losing as you learn. This approach not only minimizes your risk but also provides a practical learning experience. As you gain confidence and a better understanding of the market and the strategies of the traders you’re copying, you can gradually increase your investment. This measured approach to scaling up your investment helps in building a solid foundation in trading, ensuring you make informed decisions based on experience and knowledge, rather than diving in without a clear understanding of the risks and strategies involved.

Continuous Learning

Engaging in continuous learning is crucial for success on Exness Copy Trade. You should actively seek knowledge about financial markets, trading strategies, and the specific assets you are trading. This ongoing education helps you understand the decisions of the traders you copy and equips you with the skills to eventually develop your own trading strategies. Attend webinars, read relevant articles, and participate in community discussions to stay updated with market trends and new trading techniques. By embracing a mindset of continuous learning, you not only enhance your ability to make informed decisions but also adapt to the ever-changing market conditions, which is essential for long-term success in trading.

Conclusion

In conclusion, Exness Social Trading offers a unique and accessible platform for both novice and experienced traders to engage with the financial markets. By carefully selecting traders to copy, utilizing the diverse range of tradable assets, and applying effective risk management strategies, users can navigate the complexities of trading with greater confidence and potential for success. The importance of continuous learning, starting small, and regularly reassessing strategies cannot be overstated in this dynamic environment. Exness Copy Trade, with its robust platform and supportive tools, presents an excellent opportunity for individuals to grow their trading expertise and potentially enhance their financial portfolio.